Lots of info here but it is interesting the way they are already planning a way to combat the time we will get for parcels to the door in RRECS

Note: Sixty-one percent of routes USPS defines as “Rural” are in areas the OIG has classified as Medium Density. In 2004, the city and rural carrier unions and the Postal Service agreed that Rural Routes in areas that have been fully developed need not be converted to City Routes just because of their urban or suburban characteristics.

The Low Density category captures parts of the country where the houses are far apart and most of the land is farmland or undeveloped. Unlike other areas, package growth in Low Density areas remained strong in FY 2019, given that the Postal Service faces less competition there for last-mile delivery. But operational challenges remain. Carriers may spend a great deal of time driving down country roads to deliver to the most remote locales. Depending on the residence or the size of the package, carriers may also be required to walk a package from their vehicle to the front door, a potentially long distance over uncertain terrain. In addition, a new system for evaluating Rural Carrier pay will make door deliveries more costly for the Postal Service. That new system is expected to be implemented within the next year or two, and USPS does not have a mechanism to recoup those higher costs—beyond general price increases

The Rural Carrier manual mandates door delivery of large packages if the address is within a half-mile of the route or if the customer has pre-arranged daily home delivery. The Postal Service also has mandated that all Sunday deliveries go to the door even if they fit in the mailbox because customers do not check their mailboxes on Sundays. In all other cases, the carrier is supposed to either leave the package next to the mailbox or put a note in the box asking the customer to come pick up their package at the post office. Some carriers make door deliveries anyway in an effort to provide better customer service.

Rural Carriers Will Get Paid More for Packages

Currently, Rural Carriers are not paid more when deliveries take longer. Unlike City Carriers, who are paid hourly, Rural Carriers get a flat salary based on the “evaluated” time for their routes. The Rural Carriers union and the Postal Service have agreed to a set of time standards that apply to all of a Rural Carrier’s actions. For example, carriers are allowed 20 seconds to sort a package in the office and 10 seconds to deliver it.

However, the Postal Service will soon be transitioning to a different evaluation system to account for the number of door deliveries each Rural Carrier makes. The Rural Route Evaluated Compensation System (RRECS) will use parcel scan data to determine how many packages were delivered to the door on a given day and compensate the carrier accordingly.

Large and Heavy Packages are Especially Difficult to Deliver

Packages got an average of 18 percent heavier between FY 2013 and FY 2018.41 Mattresses, furniture, and dog food are among the bulky items now being delivered directly to your front door. The vast majority of parcels delivered by the Postal Service are small and lightweight, with percent coming in at two pounds or less. But the number weighing 30 pounds or more has jumped [REDACTED]

Figure 8: Large Parcels

Although the Postal Service, per policy, is not supposed to accept any package weighing more than 70 pounds, carriers say it is happening anyway. In FY 2018, the number of Parcel Select Ground packages entered into the system as 70 pounds was times higher than the number entered as 69 pounds. Unless there happens to be an unusual number of items that weigh exactly 70 pounds, it may be that heavier packages are being improperly accepted and entered into the system at the maximum recordable weight of 70. Further study on the acceptance of packages over the weight limit is warranted to understand the scope of this issue.

Similarly, the Postal Service may be accepting packages that are too big or difficult to maneuver. USPS parcel size limits vary by product, but in no instance is a package allowed to be more than 130 inches in length plus girth. Figure 8 depicts carriers holding packages that appear to violate the 130-inch rule. They are also encountering cumbersome packages like ones labeled “Team Lift,” yet carriers have no partner to assist them. Regardless of weight, cumbersome boxes like these are hard to get in and out of the vehicle and hard to carry to the customer’s front door.

Is the Postal Service Getting Stuck with the Packages that are Hardest to Deliver?

Big, heavy, or oddly shaped boxes are difficult to handle under any circumstance. They can be even harder in Low Density areas, where the walk from vehicle to house may cross gravel or uneven ground. Low Density areas saw a increase in the average weight of Parcel Select Heavyweight packages between 2017 and 2019

FedEx and UPS recoup the additional cost of hard-to-deliver packages through the application of “additional handling surcharges” on heavy parcels. While the weight threshold for these surcharges was previously 70 pounds, both UPS and FedEx lowered the threshold to 50 pounds in 2020. The carriers also have long had sophisticated systems for surcharging packages based on their size, which is known as dimensional weight pricing. The Postal Service does not apply a surcharge to heavy packages. While the lack of special handling fees compared to FedEx and UPS can make the Postal Service a more attractive option for price- conscious shippers, it also makes it a potential dumping ground for bulky, hard-to- deliver packages.

Avoid the Most Difficult Door Deliveries in Remote Areas

Centralized deliveries in Low Density areas—like centralized deliveries anywhere—are generally faster and more efficient. These often take the form of roadside cluster boxes along rural roads . In small towns, centralized delivery is even easier, because customers living within a quarter mile (in some cases a half-mile) of the post office generally must pick up their mail from free P.O. boxes at the post office

While private carriers generate additional revenue from rural delivery surcharges, the Postal Service generates no more revenue from a delivery to the top of a mountain than it does to a suburban mailbox.

As discussed earlier, the current Rural Carrier wage system does not pay carriers more when deliveries take longer. The Postal Service has little incentive to centralize package deliveries, especially if it must invest money to do so. But once the RRECS compensation system is instituted, Rural Carriers will be paid more for door delivery than for curbside or parcel locker delivery. Under the new pay system, optimizing rural package deliveries will have an immediate financial benefit for the Postal Service.

One way to centralize deliveries is to install more outdoor parcel lockers along Low Density routes. Parcel lockers could potentially be built at road junctions where rural cluster boxes already sit. As long as the package isn’t oversized, the carrier would be able to deposit it into the locker in the same location where she or he drops off the mail, thus avoiding a door delivery. Just as urban lockers could be placed in select apartment buildings for maximum impact, rural lockers could be placed at the most advantageous road junctions— avoiding long drives, difficult roads or terrain, and homes that are set far back from the street. As part of the RRECS rollout, the Postal Service is mapping the precise GPS coordinates of roadside mailboxes and customers’ front doors. The Postal Service could use that location information, along with parcel volume data, to identify the places where parcel lockers would most improve package delivery efficiency and begin some small pilot tests.

Using simplified cost assumptions, we can estimate the return on investment of a roadside parcel locker in a Low Density area. Imagine an unpaved road with several houses on it, spaced far apart, where the carrier delivers an average of two large packages a day. Two door deliveries down that road cost the Postal Service $2.04 in wages each day, or $617 annually. According to a USPS representative, buying and installing a common brand of outdoor parcel locker consisting of four compartments costs about $1,000. If the locker eliminated 90 percent of door deliveries for the addresses it served, USPS would recoup the investment in about 2.4 years.

Not all Low Density package delivery can be centralized, though; many rural homes have standalone curbside mailboxes that are not clustered. In such cases, avoiding door deliveries could be accomplished through bigger mailboxes that fit bigger parcels. In fact, the Postal Service has been promoting a larger “Next Generation Mailbox” since 2015 . Though their size varies slightly by manufacturer, the Postal Service estimates that they can fit 70 percent of all parcels.

It is currently up to residents to install and pay for Next Generation Mailboxes. The Postal Service could incentivize or mandate customers to purchase these new mailboxes and perhaps subsidize the $60 to $70 retail price for the most costly delivery points. Pilot studies could be conducted to determine the appropriate mailbox subsidy and to identify successes and challenges of subsidizing the larger mailboxes prior to large-scale implementation.

Analyze Data on Costly Carrier Activities

The Postal Service collects a large amount of data on parcel delivery operations. These data are used to evaluate carrier routes, calculate extra mileage on rural routes, and identify the rate of failed delivery attempts, among other uses. However, the Postal Service could better utilize the data to drive efficiencies in package delivery. Conducting more data analysis on the challenges of High and Low Density package delivery would allow the Postal Service to better understand the scope of delivery inefficiencies and identify the costliest deliveries. While the Postal Service measures the average national costs of parcel delivery, it does not address the distinct costs of deliveries in Low Density areas or urban apartment buildings.

The Postal Service could collect more and better data on these costs. It also could analyze that data more deeply and broadly to understand how the costs of parcel delivery vary across the country and in the more rural and urban parts of the country. To be clear, this is beyond the accurate capture of delivery costs in urban and rural areas. Rather, USPS should analyze its data with operational efficiencies in mind.

One way to analyze existing data with an eye toward operational efficiency is by using the Postal Service’s ‘breadcrumb’ data of carriers’ GPS locations. These data are used primarily at the local level to track individual routes. However, local managers may not have the bandwidth to analyze these data or to identify systemic issues that result in delivery inefficiencies. Breadcrumb data could be used to identify delivery points that require more time, or to determine how often carriers make second trips or backtrack on their route to deliver missed parcels. Currently, the Postal Service collects backtracking data from the annual route inspection (PS Form 3999), though the data are only a one-day snapshot of a carrier’s route. The Postal Service could also analyze aggregate data from route inspection forms to identify certain characteristics associated with more or fewer second trips or backtracking, including whether carriers who used the Package Lookahead feature on their scanners had fewer instances of backtracking.

On rural routes, the Postal Service could use data from the Rural Carrier Trip Report (PS Form 4240) to determine how often second trips are occurring due to parcels. These examples demonstrate some ways the Postal Service could analyze existing data within the framework of increasing parcel delivery efficiency.

The Postal Service is already using some package data to identify and address inefficiencies. New carriers receive training on tools designed to reduce the time spent on backtracking and searching for packages. In addition, the Postal Service analyzes data on failed first attempts to identify geographic areas with high rates of failed package delivery attempts. Parcel lockers are installed in some of these areas, and the reduction in failed first attempts is monitored. This is one example of how existing data can be used to drive efficiencies in package delivery. These data do have limitations, as USPS has only partial knowledge of the number and location of its parcel lockers.

The tracking tool was only rolled out in 2018 and has no historical record of prior locker installations. Also, it does not record lockers installed by developers as part of new housing construction. Similarly, it does not know how many customers have installed Next Generation Mailboxes. USPS could pilot efforts in a few regions to measure the savings it gains from the larger mailboxes.

We noted earlier that USPS does not measure how package delivery costs differ in cities and rural areas. It has estimates for the national average cost associated with different modes of City Delivery (door vs curbside vs cluster box), but those estimates do not account for the wide array of conditions within each mode. A door delivery up three narrow flights of stairs is significantly harder than dropping off those pieces with a concierge or a door delivery to a sidewalk- adjacent suburban home. It would benefit the Postal Service to know the degree of difference so that it can target innovations toward the most difficult or costly deliveries. It could start by studying the most time-consuming types of delivery points to estimate how delivery costs to those types of addresses differ from the overall average.

Because their salary is basically pre-determined, changes to a Rural Carrier’s package volume or delivery times do not result in an immediate salary change.

The financial impact of a volume increase is only felt when the route is re-evaluated, which generally happens, at most, once per year. The impact of a delivery time increase – for instance, if larger parcels are forcing more door deliveries – may not be felt for years.

There is no opportunity for a Rural Carrier to get paid more based on time alone; there must be a volume increase for her salary to change. The exception is if a Rural Carrier works enough to earn overtime pay, which is 150 percent of regular pay. Although Rural Carrier overtime is rare, it has been growing.

Instead of a time standard of 30 seconds per package, carriers will receive 2.443 minutes of pay for each door delivery, 0.602 minutes of pay for a parcel locker delivery, and 0.403 minutes of pay for a curbside mailbox delivery. Door delivery scans represent just one aspect of a complicated compensation system for Rural Carriers. The Postal Service expects RRECS to be implemented within the next two years.

The cost of door deliveries will add up quickly under the new evaluation system. Currently, about 30 percent of packages in Low Density areas are delivered to the customer’s front door. These door deliveries add an additional 41 minutes per day to each route. Under RRECS, those 41 minutes per day would cost the Postal Service $139.3 million in annual wage payments.

The RRECS system allots 2.443 minutes per door delivery, or 4.886 minutes for two. 4.886 minutes times $0.417 in salary per minute ($24.99 hourly salary divided by 60) equals $2.04 per day. Multiplied by 303 delivery days, the annual salary payments equal $617.

RRECS allots 0.602 minutes for a parcel locker. Assuming a carrier delivers two packages per day down this rural road and assuming a parcel locker can accommodate 90 percent of those packages, the carrier would deliver 545.4 packages per year to the parcel locker and the remaining 60.6 packages to the customers’ door. The total cost of delivering 90 percent of packages to a locker and 10 percent of packages to the door would be $198 annually.

The cost savings from installing a parcel locker would be $419 per year ($617 – $198). If the parcel locker costs $1,000 to purchase and install, the Postal Service would recoup its investment in about 2.4 years.

This estimate only uses the wage cost and the cost of the parcel locker. It does not account for other costs, such as a carrier’s mileage allowance or additional costs associated with the purchase, installation, and maintenance of the locker.

Comparison of Total Package Volume to Same Period Last Year

The Postal Service reported that competitive product volume increased 35 percent in April and 61 percent in May compared to the same months in 2019.75 OIG analysis showed a similar package volume pattern, with weekly volume changes peaking the week of May 16, 2020, before easing in June.

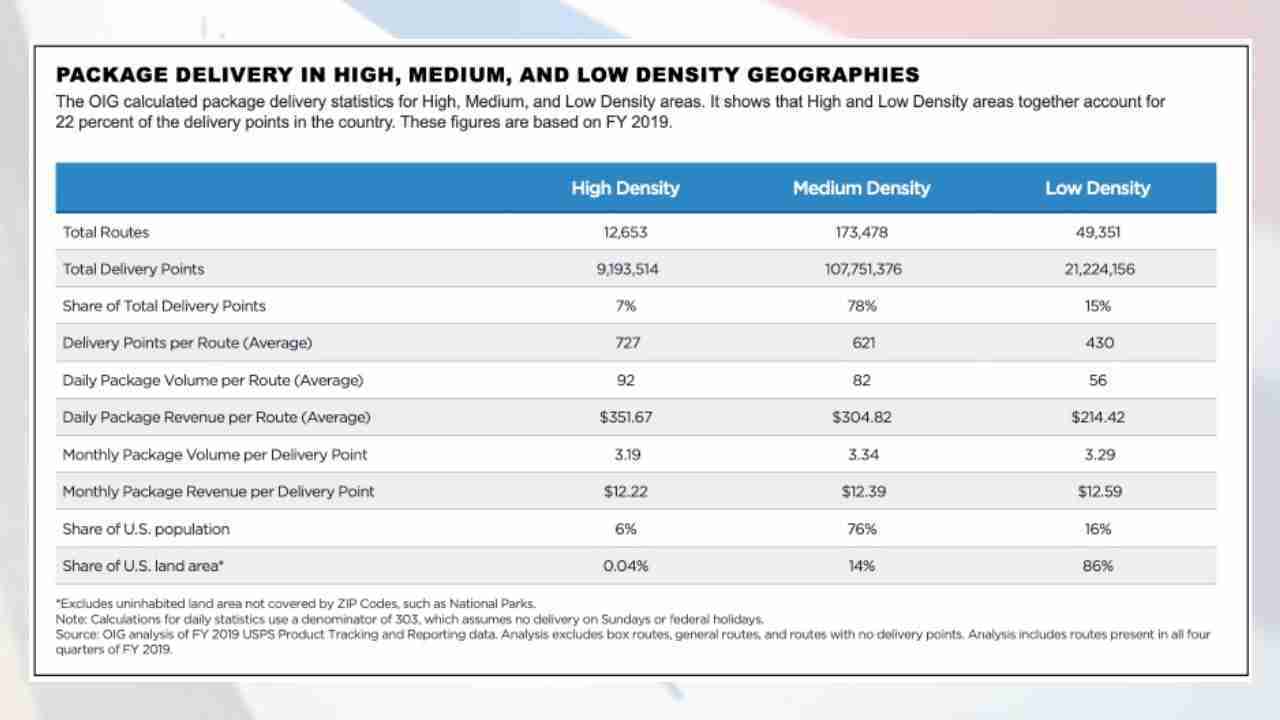

Package Volume in High, Medium, and Low Density Areas

In the first two months of 2020, package volume in High, Medium, and Low Density areas continued in the same patterns described earlier in this paper, with volume declines in High Density areas and volume increases in Low Density areas. These patterns began to shift in March as package volume increased everywhere.

Package volume peaked the week of May 16th. During that week, the Postal Service delivered 187 million packages, which was 73 percent more

than the previous year. However, the greatest percentage increases in package volume came at the end of June when Medium and Low Density areas saw year- over-year volume increases of 83 percent and 79 percent, respectively.

Volume increases in High Density areas were generally not as pronounced as those occurring in Medium and Low Density areas. In High Density areas, volume increases compared to the same period the previous year increased as much as 77 percent.

Comparison to Holiday Package Volume

Package volume during the COVID-19 pandemic approached package volume typically seen during the holiday season. Pandemic-related package volume increases peaked the week of May 16, 2020. Compared to 2019 holiday volume, pandemic-related package volume soared to as much as 96 percent of holiday volume in High Density areas. COVID-19 package volume was as high as 92 percent of holiday volume in Medium Density areas and 91 percent of holiday volume in Low Density areas.

Pandemic-related volume changes began to ease in June 2020, though volume continued to remain well above expected levels. It remains to be seen whether the Postal Service’s package volume will return to more typical levels or whether the surge in online retail represents a fundamental shift in package volume trends for the Postal Service.

Management’s Comments

Management agreed with the OIG recommendation. The Postal Service will use parcel delivery scan data to identify possible locations for new parcel lockers and analyze the cost effectiveness of parcel locker installation. The planned completion date is March 2021.